Here's how it works:

The Extended Insurance Account at Hoosier Hills Credit Union provides expanded protection for your deposits while maintaining seamless access and full visibility.

When you deposit funds into your primary account, our Auto-Sweep system automatically distributes portions of your balance—each under $250,000—across our network of partner credit unions. This ensures that every dollar remains within NCUA insurance limits, allowing your deposits to be protected up to $10 million!

Despite being distributed, your funds remain fully and easily accessible through your primary account, where you can track all movements and balances in real time. With this system, you get the security of extended insurance without any extra effort on your part.

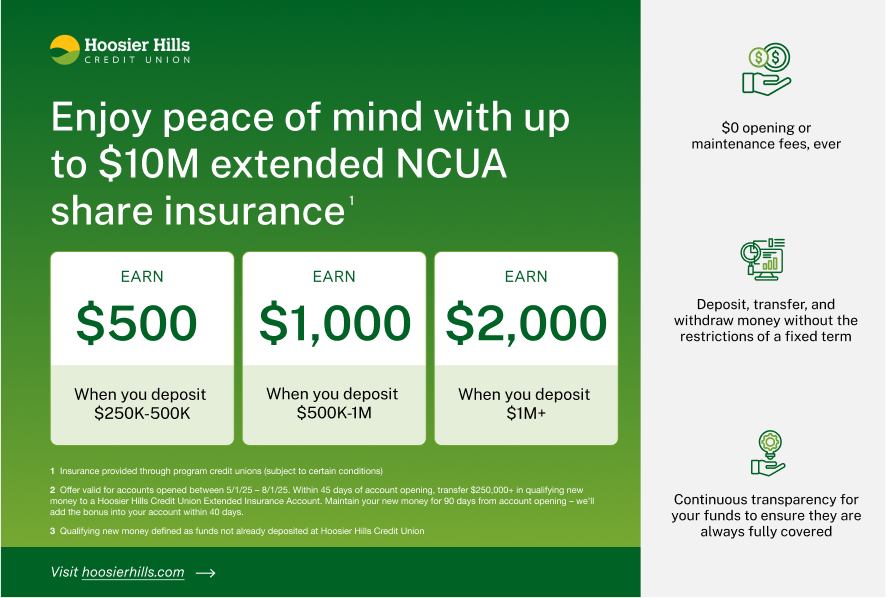

Protect More. Earn More. Up to $10M in Extended Share Insurance and Receive a Cash Bonus!

- Extended Insurance: Your personal savings are protected up to $10M through our NCUA-insured partner network, all managed through one account.

- Competitive Rates: Earn interest on your full balance while protecting your deposits.

- 24/7 Transparency: Track your funds and account activity in real-time through our safe and secure online platform.

-

Personal High Yield Money Market

Open a High Yield Money Market Account and enjoy safe, easy access to your funds while watching your savings grow.

-

Commercial High Yield Money Market

Open your Commercial High Yield Money Market Account and enjoy safe, easy access to your funds while watching your savings grow.

-

Savings Rates

Check out the current rates we offer.

-

Certificates

Earn higher dividends without the risk.

Disclosures

Funds participating in the Hoosier Hills Credit Union Extended Insurance Account are deposited into accounts at participating credit unions, which are insured by the National Credit Union Association (NCUA) for up to $250,000 for each category of legal ownership, including any other balances you may hold directly or through other intermediaries, including broker-dealers. The total amount of NCUA insurance for your account depends on the number of credit unions in the program. If the balance in your account is greater than the NCUA insurance coverage in the program, any excess funds will not be insured. Please read the Program Terms and Conditions carefully before depositing money into the program and for other important customer disclosures and information. To assure your NCUA coverage, please regularly review credit unions in which your funds have been deposited, and notify Hoosier Hills Credit Union immediately if you do not want to allocate funds to a particular credit union or credit unions.